Strategy 42/42 Plan

On the Strategy earnings call late last week they announced their new 42/42 plan which is an extension of their initial 21/21 plan of raising fund to buy Bitcoin. Just 6 months after the 21/21 plan, Strategy just unveiled that it intends to secure a total of $84 billion of capital over the next 24 months to support its Bitcoin treasury. With their total purchases to date under the 21/21 plan this would leave them with $56.7 billion to use by December 2027. Saylor noted they would issue new financial instruments for raising this capital beyond what it's already doing. Strategy holds the first mover advantage and while others are copying their approach it will be next to impossible for them to catch up. The stock was up 3.5% on Friday after the news.

Another Bitcoin Purchase incoming, the only question is how much will it be this time? With so many companies, ETFs, and sovereign funds buying how long will the supply of Bitcoin last on exchanges?

Bloomberg Ups the Odds of New Crypto ETFs

Bloomberg analyst Eric Balchunas increased the chances of several new crypto ETFs to become approved in 2025. His outlook has improved based on more favorable comments and trends by the US regulators. The Solana ETFs odds increased from 70% to now 90% along with Litecoin. Six asset managers have filed and are awaiting approval from the SEC on their Solana ETFs which will include staking a first in any ETF offering. In March the Chicago Mercantile Exchange (CME) listed futures contacts tied to Solana, which is a great sign for the pending ETFs approval. XRP and Dogecoin also got a boost up to 85% and 80% respectively.

Quick Hits

- Governor of Arizona goes against the House and the Senate and vetoed the Bitcoin reserve act.

- Blackrock who holds $11 trillion in assets says Banks are looking to buy Bitcoin.

- Trump wants crypto, if we don't do it China will.

- Cathie Wood from Ark Investments says Bitcoin trend with Gold will continue and will increase the Bitcoin price.

- Fold the first publicly traded Bitcoin financial services company rings the opening bell on the Nasdaq.

- 75% of US Merchants plan to accept crypto as payment within the next 48 months, per Captial One survey.

- Apple lifts IOS restrictions that banned in-app crypto payments.

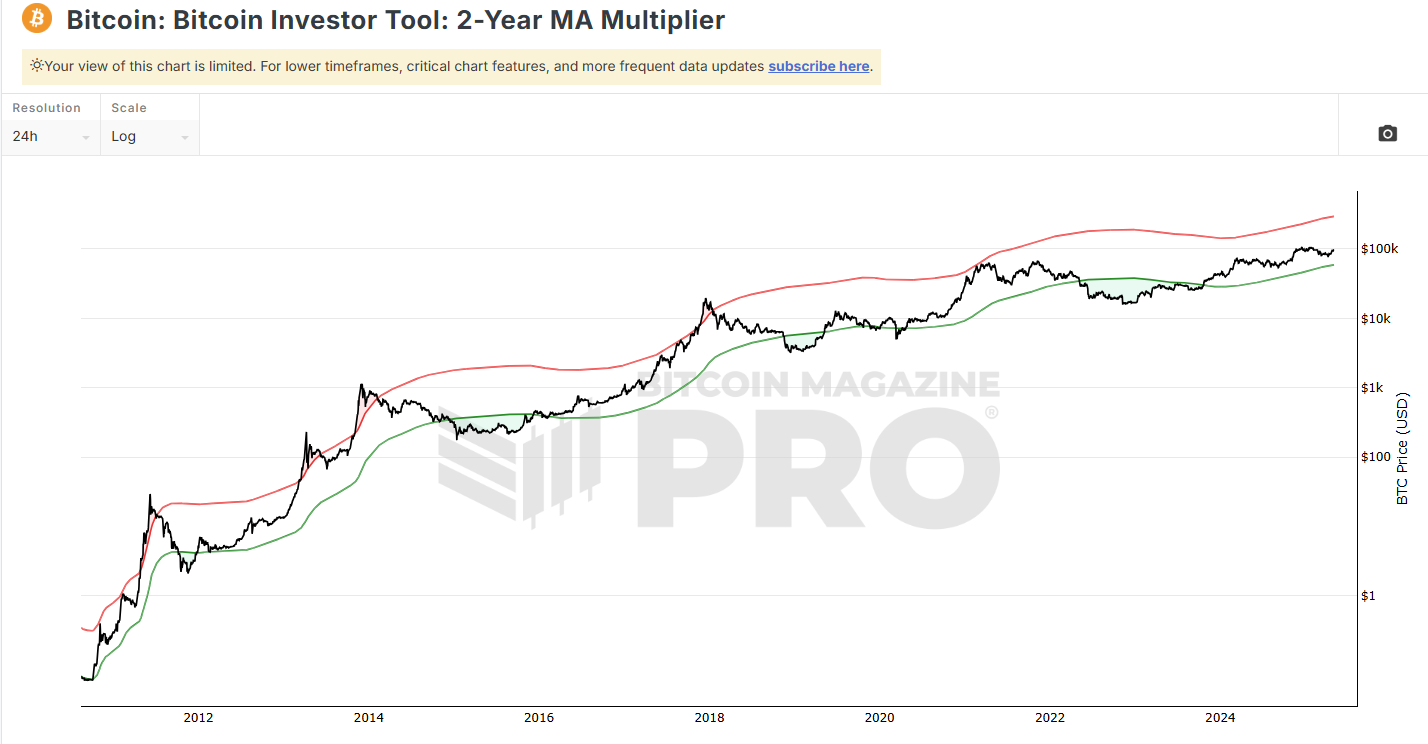

Technical Chart Corner

2 Year Moving Avg Chart show Bitcoin has much more room to go up.